2020 was a great year for Swedish alt-milk brand Oatly. Environmental concerns about cow’s milk coupled with the way that its quirky marketing captured the imagination of consumers propelled the brand to new sales peaks. Although grocery sales generally increased during initial pandemic lockdowns, oat milk sales increased 289 percent compared to dairy’s 25 percent rise.

The company boasted $200m in sales in 2019, double what it reported in 2018. And with an investment last year of $200m for a 10% stake of the company, Oatly is now worth $2bn.

It has high levels of brand loyalty too. “When shoppers are buying non-dairy milk, 70% have a specific brand in mind (higher than the industry average of approximately 65%),” Nikhil Sharma, vice president of North America Consumer Analytics at Nielsen, told FOX Business.

Yet today the company stands at a crossroads. It has confirmed that it has instructed bankers to begin preparations for an IPO later in the year, the process in which companies go public enabling anyone to buy shares. Yet for the IPO to be successful it needs to maintain its image as a growing and progressive brand, and back that up with excellent sales figures.

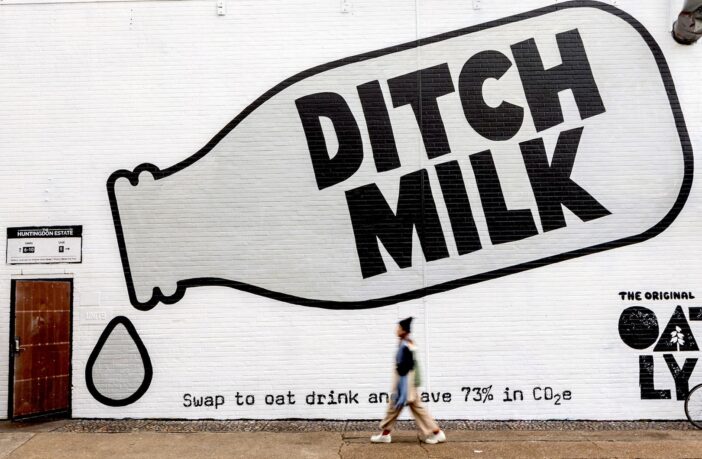

It does seem to be continuing to entice consumers away from cow’s milk and arguably more environmentally damaging alt milks such as almond and soya. Yet at the same time is starting to deal with a backlash from the customers who championed the brand in the first place – its original vegan fans.

In 2020 the company secured a $200m investment with Blackstone. The company, which is one of the largest private equity firms in the world, not only has a founder Stephen Schwarzman, who apparently funded part of Trump’s re-election campaign but also backs the Brazilian company, Hidrovias, which was accused of being actively pushing deforestation of the Amazon. Admittedly Blackstone has denied Hidrovia’s involvement in this, but it’s a charge that is starting to stick in vegan circles.

In many ways this underlines the dilemma that would be global vegan brands will have as they attempt to scale.

On the one hand scaling is good. The number of cows lives that have been saved by the popularity of Oatly is huge to say nothing of its very positive impact on the environment, And let’s not forget I write this on a day when the temperatures figures for 2020 were unveiled and turned out to be the hottest ever recorded.

Yet companies with big ambitions need investment and even today, in spite of many investment firms’ commitment to social responsibility, a lot of cash comes with baggage. And then there’s the issue of China. If you want to make a real impact why not address the world’s largest potential market for your product. Yet as Oatly discovered when the Chinese state-owned investment firm China Resources bought a 30% stake in the company in 2016 there will be lots of people lining up to highlight China’s poor environmental and human rights records.

“One of the reasons [for Chinese owners]was to enter the Chinese market. The country’s dairy consumption is on the rise and it would not be sustainable if China took our Western living habits. It would be a climate disaster,” Oatly’s creative director Martin Ringqvist told Sifted in 2019. “We have an obligation to be there to offer a sustainable alternative.”

Oatly appears to be taking the criticism on the chin. “It’s always sad to part ways with consumers. But those who’s been with us for a while know that it has always been in our DNA to challenge the status quo and do what we believe is right to change the world to the better, rather than what is easy or comfortable,” says Linda Nordgren, communication manager at Oatly, in a written statement to Sifted.

Let’s not forget too that for all the fluffy environmental messages it pushes on its carton Oatly exists to make money, albeit, hopefully with a sense of purpose. The company also talks about smashing the system from within and pushing nasty investment companies towards ethical companies and goals.

But is that going to wash with consumers? There was a time when ethical concerns were largely the preserve of hardcore vegans and environmentalists, now though this clearly isn’t the case.

It will matter to Oatly in a few month’s time when the company launches its IPO and anyone can buy shares in it. Public perception will play a huge part in its valuation.

Clean investment cash

It isn’t just Oatly though. There are a number of emerging potential vegan super brands (Impossible Foods, Moving Mountains, Gold&Green Foods, Minor Figures) etc that are facing a similar dilemma and may need investment capital to ascend to the next level. Vegan companies have championed these brands and have real loyalty to them, yet if the brands take the money to enable them to grow – and in theory, save more animals and have a positive impact on the environment – they might find they are alienating the fans who helped build them their business. And does it matter who owns vegan brands? Violife vegan cheese has become incredibly popular, yet it is owned by Upfield, which is also backed by a private equity fund and the same companies owns dairy brands Flora and I Can’t Believe It’s Not Butter.

The obvious solution is to take money from one of the many clean, ethical funds. Let’s not forget that Natalie Portman and Oprah Winfrey are both Oatly investors. Yet most of these are still fairly small and besides but the right financial deal for a company might not always be the most ethical one.

So what do you think? Is the potential impact of vegan mega brands compromised by the way they raise cash? Are you not drinking Oatly any more?